History

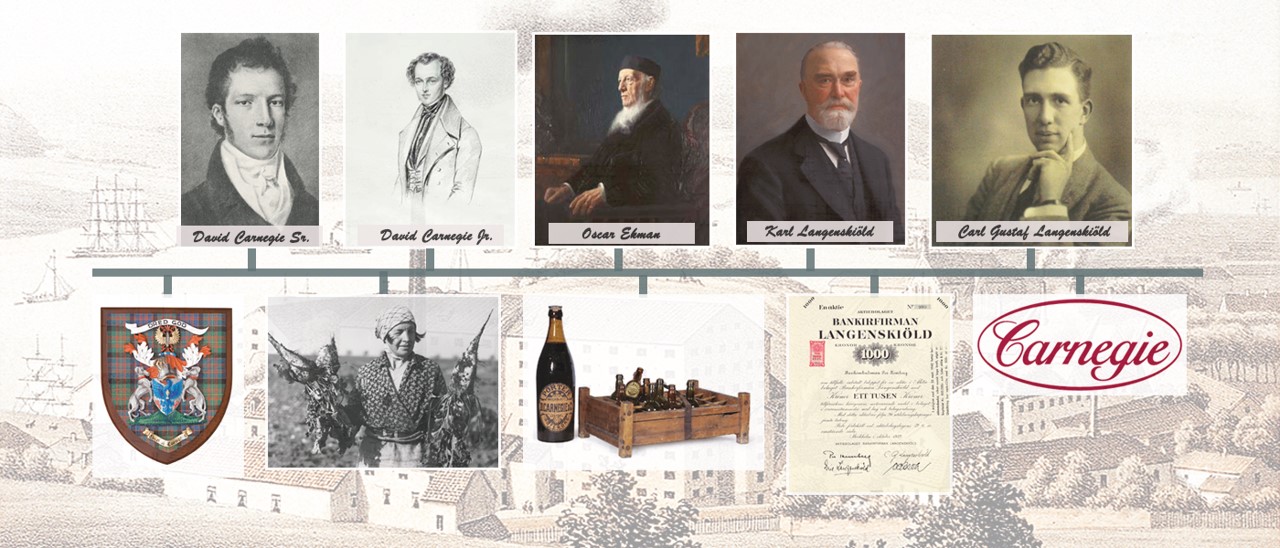

Carnegie, founded as a trading house by David Carnegie in 1803, is one of the Nordic region’s oldest trademarks. The company comprised a variety of operations and the streamlining towards financial services was initiated with the formation of the investment bank Bankirfirman Langenskiöld in 1932.

Carnegie in its modern format was formed when its equity brokerage operations expanded in the late 1960s and a number of successful stockbrokers were recruited. Equity research activity was gradually increased and Carnegie developed into a broader investment bank in the 1980s, with a focus on brokering Nordic equities to local and global institutions.

Carnegie grew sharply in the 1990s and its broad knowledge of Nordic companies was utilised to expand M&A, IPO and ECM advisory operations. Carnegie successively built up a network of wealthy private individuals in private brokerage. This formed the foundation for private banking services, which became a separate business area in 2004. With the acquisitions of HQ Bank and HQ Fonder in 2010, Carnegie assumed a leading role in private banking and in actively managing funds in Sweden.

Carnegie has an entrepreneurial heritage and has been a pioneer in several areas. Carnegie transformed equity brokerage in Sweden in the 1960-70s. In the 1980-90s, Carnegie was quick to recognise the potential of selling Nordic equities to foreign institutions and was the first Nordic player with offices in both London and New York.

Success was the result of driven employees, a strong track record, customer-oriented work methods, in-depth knowledge of the Nordic markets and strong global distribution.

1803

On 4 May 1803, Scotsman David Carnegie founds the trading house of D. Carnegie & Co AB in Gothenburg.

1836

David Carnegie Jr acquires the Lorent sugar refinery and porter brewery in the Klippan area of Gothenburg

David Carnegie Jr acquires the Lorent sugar refinery and porter brewery in the Klippan area of Gothenburg

1932

Carl Gustaf Langenskiöld founds an investment bank, Langenskiöld, whose main business is asset management and brokerage.

1980

The Langenskiöld investment bank changed name to Carnegie in 1980 and in the late 1980s expanded its businesses into Denmark, southern Europe, London and New York.

Some 20 years ago – re-listing on the Stockholm Exchange

In 1994 the British merchant banking group Singer & Friedlander aqcuires the Carnegie Group from Nordbanken (previous PK Banken, currently Nordea). The ownership was controlled and divided through the newly formed company Carnegie Holding, where Singer & Friedlander owned 55 percent and employees of Carnegie (through the company D. Carnegie & Co) owned remaining 45 percent.

Six years later, following a decision to list the Carnegie Group, Carnegie Holding was merged with D. Carnegie & Co, with the latter to become the Parent company of the Group. And on June 1, 2001, D. Carnegie & Co was listed on the Stockolm Exchange. The offering was subscribed more than 30 times and the market capitalization at the offering price was SEK 7.7 billion.

Recent years

In the wake of the financial crisis of 2008, the Swedish National Debt Office takes over ownership of Carnegie and the company is delisted from the stock exchange. In beginning of 2009, Carnegie is sold to the private equity firm Altor and the investment company Bure. A new strategic roadmap allows Carnegie to gradually regain its market position and by 2010 the position is reinforced as Carnegie acquires its competitor HQ Bank and HQ Fonder. Since, Carnegie has continued its strong development and established a leading market standing in all areas of operations, while gradually increasing its focus on advisory services in the Nordics.